To qualify tax return must be paid for and filed during this period. Effective from January 1 2022 until December 31 2026 the government has decided to exempt income tax on foreign-sourced income for individual taxpayers.

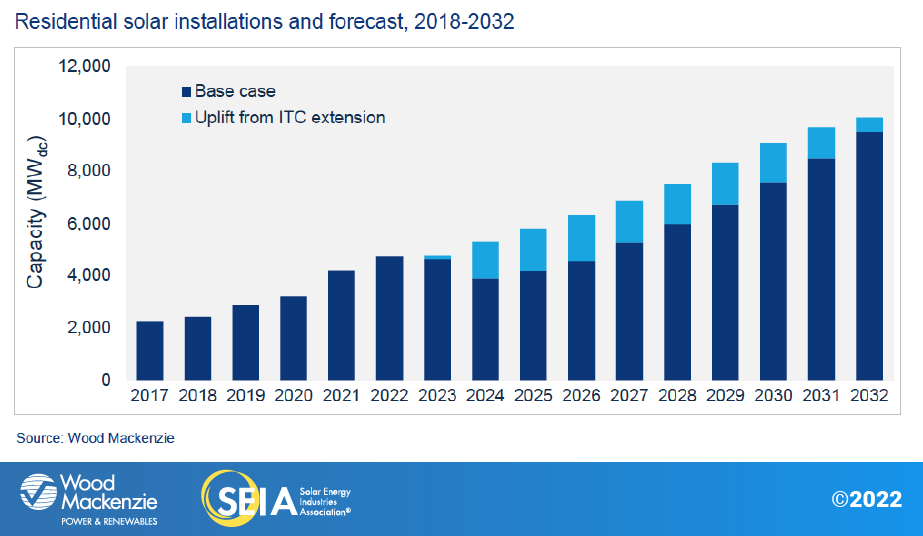

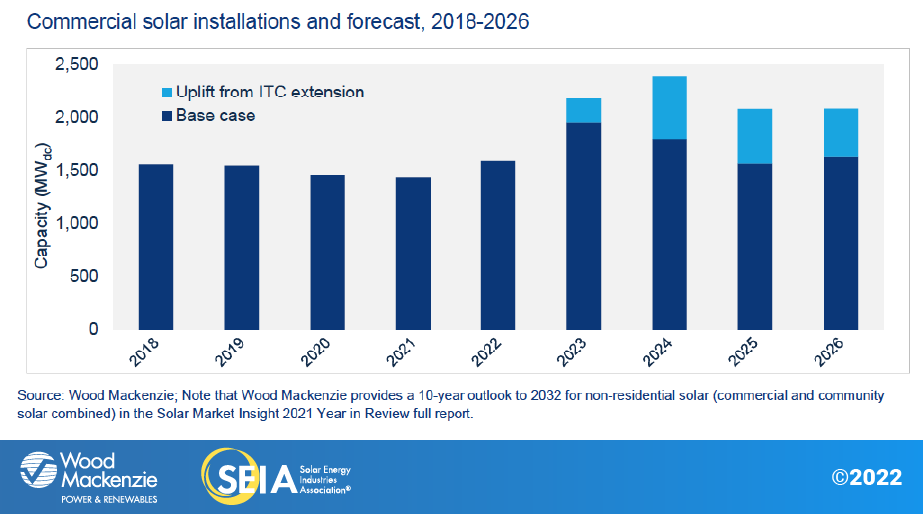

Solar Market Insight Report 2021 Year In Review Seia

W-01A-275-042018 Case Report Tax Appeal before the Special Commissioners of Income Tax.

. For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. Sales tax was reinstated on 1 September 2018 as Malaysia moved away from the former GST regime. Sales tax was reinstated on 1 September 2018 as Malaysia moved away from the former GST regime.

It is considered in Islam as a religious obligation and by Quranic ranking is next after prayer in importance. He has a proven track record for helping international. UNCDF offers last mile finance models that unlock public and private resources especially at the domestic level to reduce poverty and support local economic development.

There are numerous exemptions and deductions that typically result in a range of 3540 of US. The total gross remuneration of employee chargeable to tax including. Schedule 5 of the Income Tax Act 1967.

GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. Under the Employees Social Security Act 1969 henceforth refer as Act. This relief is applicable for Year Assessment 2013 and 2015 only.

For all other back taxes or previous tax years its too. Offer period March 1 25 2018 at participating offices only. Official City of Calgary local government Twitter account.

Keep up with City news services programs events and more. Copy and paste this code into your website. The Foreign Account Tax Compliance Act FATCA is a 2010 United States federal law requiring all non-US.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Households owing no federal income tax. A recent tax case is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia.

Walmart has a portable wetdry vac available for less than 10 right now. Small value relief for personal items and duty free items. The UN Capital Development Fund makes public and private finance work for the poor in the worlds 47 least developed countries LDCs.

Korn Ferrys organizational consulting services target the most critical challenges facing global businesses today. State the total child relief taken into account in computing the employees last MTD for the Year of Remuneration 2021. That which purifies also Zakat al-mal zaˈkaːt alˈmaːl زكاة المال zakat on wealth or Zakah is a form of almsgiving often collected by the Muslim Ummah.

Essentially remote work tax relief means that youll either pay less tax to account for any money youve spent on specific things ie utilities and equipment or get a refund for the amount of tax youve paid on these specific things. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

The American Taxpayer Relief Act of 2012 raised the income tax rates for individuals earning over 400000 and couples over 450000. On the brink of famine Voted The UKs Best Muslim Charity Of The Year 2018 at the British Muslim Awards. Rental price 70 per night.

It means that for every 1 you donate to Muslim Global Relief we can claim back 25p at no extra cost to you. May not be combined with other offers. Foreign financial institutions FFIs to search their records for customers with indicia of a connection to the US including indications in records of birth or prior residency in the US or the like and to report such assets and identities of such persons to the US.

The complexity of Malaysias tax regulations means it may be advisable for foreign businesses to outsource their payroll administration. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. State the number of children on whom the employee is eligible to claim tax relief for the year 2021.

Latest news from around the globe including the nuclear arms race migration North Korea Brexit and more. Tax relief period in terms of years. It can also include goods imported or locally manufactured for use in the petroleum.

The system is thus based on the taxpayers ability to pay. Case Report Stay of Proceeding. 15-year reinvestment allowance period and special reinvestment allowance granted for years of assessment 2016 to.

As one of the Five Pillars of Islam zakat is a religious duty for all Muslims. Attracting developing motivating and retaining talent as well as creating the right structures to support that talent. Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. A Gift Aid declaration allows Muslim Global Relief to claim tax back on eligible donations.

Government of Malaysia V MNMN. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Tax revenues for 2018 and 2019 have fallen more than 430 billion.

For countries that have a double taxation avoidance agreement with Malaysia the taxpayer can claim tax relief for interest royalty and technical fees. Antoine co-founded Horizons in 2018. From January 2016 there is an income tax relief of MYR 25000 per annum for SOCSO contribution.

Special incentive schemes.

Consumer Spending Forecast 2021 Deloitte Insights

Tokio Marine Malaysia General Insurance Service Tax Faq Tokio Marine Malaysia An Insurance Company

Carmen Reinicke Csreinicke Twitter

Solar Market Insight Report 2021 Year In Review Seia

Covid 19 And Fiscal Relations Across Levels Of Government

Consumer Spending Forecast 2021 Deloitte Insights

Consumer Spending Forecast 2021 Deloitte Insights

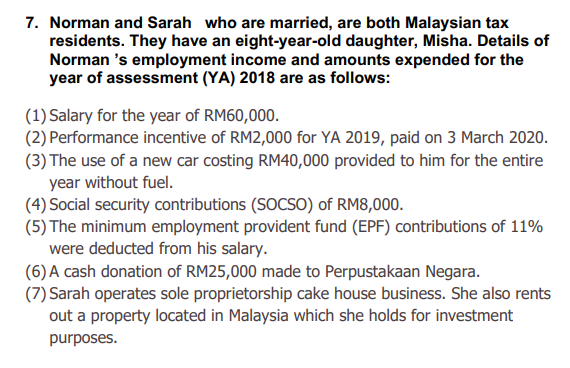

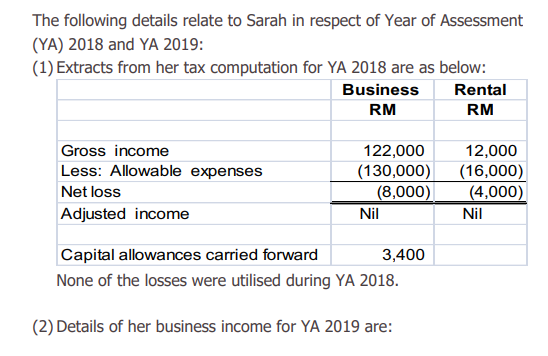

7 Norman And Sarah Who Are Married Are Both Chegg Com

Malaysian Floriculture Market 2022 27 Industry Share Size Growth Mordor Intelligence

7 Norman And Sarah Who Are Married Are Both Chegg Com

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

How To Handle Venture Capital Tax Reliefs

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

21 Tax Reliefs Malaysians Can Get Their Money Back For This 2019 World Of Buzz Relief Tax Money

Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners

Malaysian Income Tax 2017 Mypf My

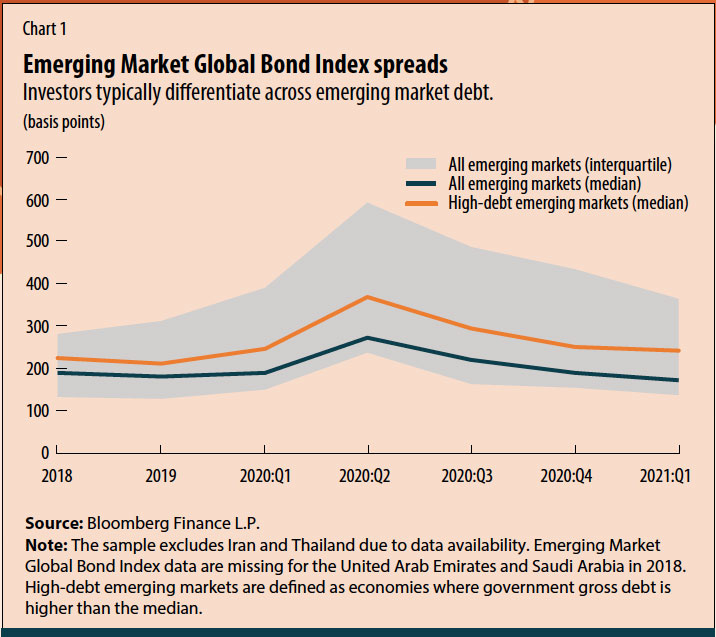

Miles To Go The Future Of Emerging Markets Imf F D

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

2017 Personal Tax Incentives Relief For Expatriate In Malaysia